Share this

How to become a Rainmaker in Investment Banking

by ModuleQ on Oct 2023

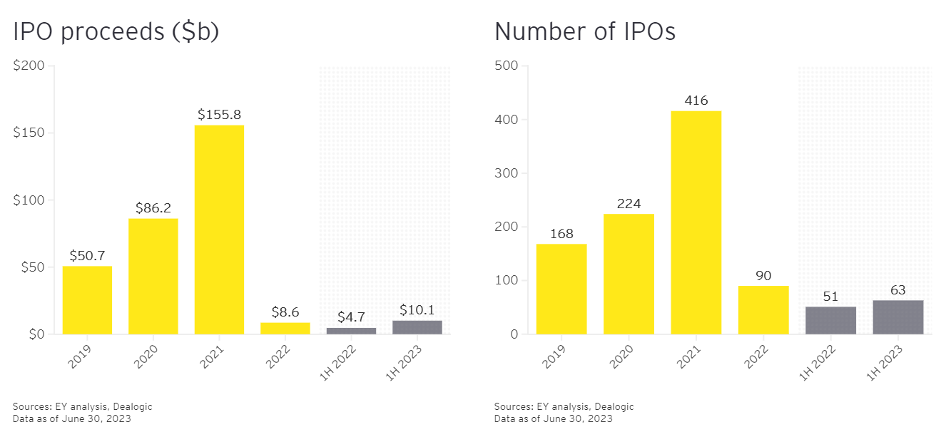

Capital markets operate in waves of activity. These cycles are broadly driven by investor sentiment, macroeconomic policy, credit conditions, and stock market performance. Many banks hoped that 2022 was a trough for dealmaking activity, but 2023 has only started to thaw. According to data from Dealogic and EY, the 1st half of 2023 saw domestic IPO activity only slightly up from the frigid first half of 2022:

This near two-year freeze in IPOs/M&A has put many investment banks in a bind. Having staffed up for a frothy capital market cycle immediately after COVID, many bankers are trying to find ways to remain active. This is particularly acute for seasoned bankers who haven’t quite reached the upper echelons of the profession. With firms sometimes looking to right-size, rank-and-file bankers are facing the brunt of it. Banks are more reticent to disrupt new hiring cycles and won’t touch their rainmakers atop. What is a banker to do?

How to Become an Investment Banking Rainmaker

The obvious answer is finding ways to drive business. This makes a banker more valuable to the bank and accelerates her career trajectory. But that’s easier said than done. Notwithstanding the challenging capital market, bankers have a lot on their plate.

The first step to becoming a rainmaker is becoming efficient with one’s existing time and effort. While that impeccable attention to detail got you past the rank of associate, bankers need to focus more on value-add and less on blocking and tackling to continue their maturation. This means a combination of delegation and using tools that deliver more. You can’t allow balls to drop, but you also can’t get stuck in your day-to-day. That means getting more efficient.

Getting More Efficient Through Unprompted AI

Efficiency doesn’t just mean throwing away manual processes. It means getting more from existing data and technology. The explosive presence of generative AI has caused less impact to the workflows of senior investment bankers than many would have thought. While analysts may use it for presentations and standard communication, more senior bankers tend to need more precision, accuracy, and context around their messaging and client interaction. These bankers need technology that works inside their existing workflows while placing little burden on themselves.

This is where Unprompted AI steps in. Banks spend heavily on procuring data and technology to equip their knowledge workers. But bankers who are tied up in existing responsibilities can’t necessarily find ways to make the most of these insights and tools.

Free Up Time to Engage With Clients

Once you get to a place of increased efficiency, the next step is to focus on revenue and retention. The first step in doing so is driving more client engagement. Client engagement is the seed that flowers into revenue opportunity. This is also where Unprompted AI comes into play. Surfacing salient information that helps deliver value to customers and prospects is like planting seeds in fertile soil. ModuleQ’s insight delivery is 3x more effective for information visibility compared to email. This is because ModuleQ’s AI combs through all of your internal knowledge graph to bring you the key insights you need daily.

If you’re spending less time hunting for information, prepping for meetings, or staying abreast of trends, that frees you to go above and beyond for a prospective IPO, issuance, or merger. That could mean moonlighting as a rideshare driver for a few hours a day, allowing you to speak more intimately to the CEO. Or it could mean taking the time to understand the one or two sticking points for the founder that would lead them to choose you over a competitive bank for their watershed moment. To move the needle, you must go above and beyond, and to do so, you need to get past the drudgery of the day-to-day. That’s what rainmakers do. They find a way.

Insights Delivery Into Your Existing Workflows

ModuleQ’s Unprompted AI solution for investment bankers pushes relevant information directly to your existing communications nervous system, whether that be Microsoft Teams, Slack, or any number of messaging solutions. These hubs are where you spend most of your day. Through pushed content, getting up-to-speed for a meeting isn’t a hunting expedition through CRMs, research portals, and team huddles. Relevant information surfaces directly on your desktop or phone, however you consume it.

Each banker has different workflows, areas of focus, and responsibilities. Information needs to be individually relevant and timely. It needs to be the right information, to the right professional, at the right moment. ModuleQ’s enterprise-focused technology is the custom tool for the modern banker’s problem. It frees up time to focus on what matters more.

Share this

- Artificial Intelligence (27)

- Press Release (14)

- Investment Banking (11)

- Industry (7)

- Product Announcements (4)

- Research (3)

- Sales Acceleration (3)

- Sales Enablement (3)

- Enterprise AI (2)

- Hybrid Work (2)

- Large Language Model (LLM) (2)

- Microsoft Teams (2)

- Security (2)

- Generative AI (1)

- Knowledge Management (1)

- Remote (1)

- Revenue Intelligence (1)

- December 2024 (1)

- November 2024 (1)

- October 2024 (2)

- September 2024 (2)

- August 2024 (2)

- July 2024 (7)

- April 2024 (1)

- January 2024 (1)

- December 2023 (1)

- November 2023 (2)

- October 2023 (2)

- September 2023 (1)

- May 2023 (2)

- April 2023 (1)

- March 2023 (3)

- February 2023 (3)

- January 2023 (1)

- December 2022 (1)

- November 2022 (2)

- September 2022 (3)

- August 2022 (3)

- July 2022 (3)

- June 2022 (2)

- May 2022 (2)

- April 2022 (1)

- March 2022 (1)

- February 2022 (1)

- November 2021 (1)

- October 2021 (1)

- June 2021 (1)

- March 2020 (1)

- September 2018 (1)

- July 2018 (2)

- June 2018 (1)

- March 2017 (1)

- November 2016 (1)

- April 2015 (1)

- January 2015 (1)